Use Your HSA/FSA Funds for Summit Athletic Club

Qualify and save ~30% on eligible memberships and fitness programs with a $20 telehealth survey.*

How It Works

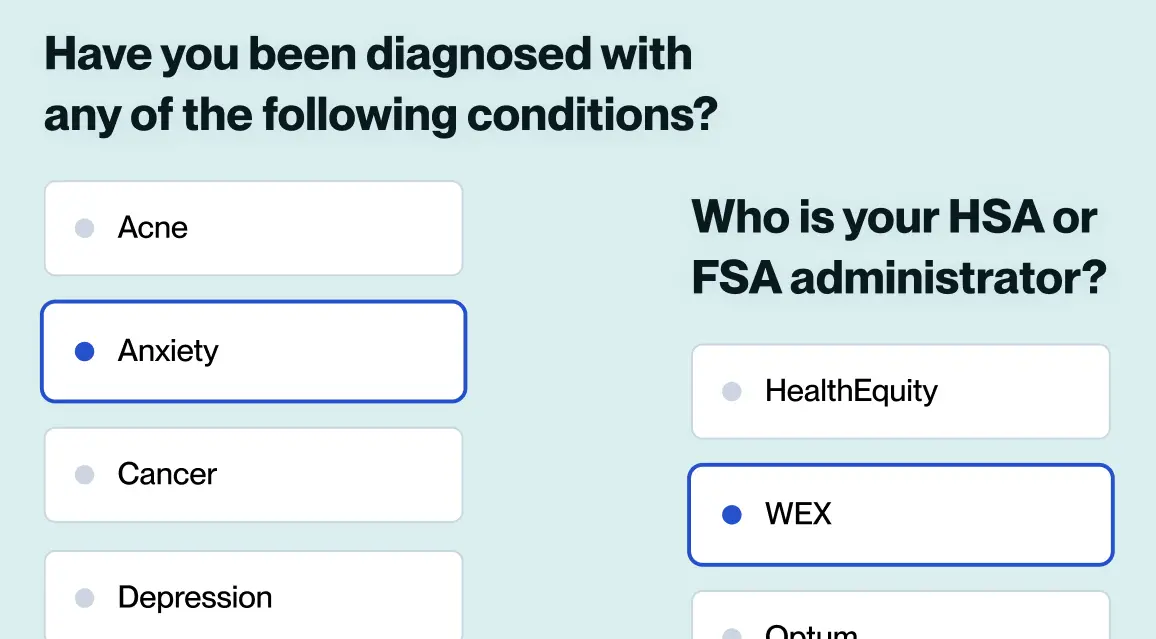

Complete Health Assessment

Take a private survey for eligibility, reviewed by a licensed provider.

Make your purchase

Do not pay with HSA/FSA during checkout.

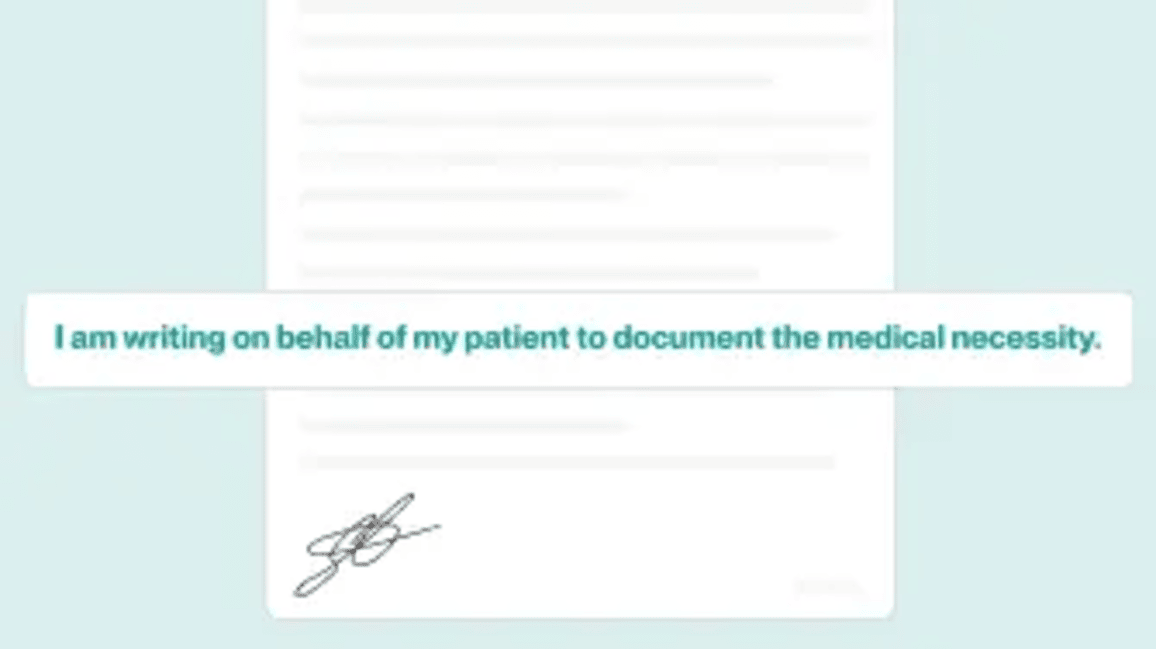

Submit for HSA/FSA reimbursement

If you qualify, you’ll receive an LMN and a guide on how to submit your purchase to your HSA/FSA administrator for reimbursement. Claims are typically paid out in 1-2 weeks.

FAQs

How does using my HSA/FSA account save me money?

HSA and FSA accounts were created to allow individuals to use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA and FSA funds are contributed before taxes, you get more purchasing power from your money. Instead of paying income taxes and then spending what remains on health-related items, qualified individuals can use pre-tax dollars to invest directly in their health.

An individual can contribute up to $4,150 pre-tax to an HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old). Almost every qualified individual saves between $1,000 and $2,000 per year, depending on their state and personal tax rate.

What is an HSA/FSA account?

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) are tax-free accounts that can be used to pay for qualified health expenses. These accounts are usually set up and managed by an HSA or FSA administrator, and you should have access to your administrator through your employer (ask your HR department).

HSAs are typically associated with a high-deductible health plan, and funds do not expire. FSAs are independent of your health plan, and contribution elections typically occur during October–November for the following calendar year. Unlike HSAs, FSA funds expire at the end of each calendar year.

Unfortunately, HSAs and FSAs are not available outside of the United States, and self-employed individuals (who do not have an HSA from a previous employer) generally do not qualify for HSAs or FSAs.

What is Truemed?

Truemed partners with merchants and brands to enable qualified customers to use HSA/FSA funds on qualified products and services that are used to treat, mitigate, or prevent a diagnosed medical condition. Truemed partners with a network of individual licensed practitioners who evaluate customers’ eligibility and issue Letters of Medical Necessity to qualifying customers, thereby saving customers money on legitimate medical expenditures.

Truemed is backed by best-in-class investors, including functional medicine pioneer Mark Hyman and founders from Thrive Market, Eight Sleep and Levels.

What is a Letter of Medical Necessity?

In order to determine whether certain products or services are legitimate expenses for treating, mitigating, or preventing a diagnosed medical condition, HSA/FSA plan administrators often require a letter from a licensed practitioner. This letter is called a “Letter of Medical Necessity.”Why should I use my HSA/FSA funds with Truemed’s partner brands?

Using your HSA/FSA funds on eligible products or services sold by Truemed’s partner brands can result in significant savings. HSA/FSA accounts allow you to use pre-tax dollars to purchase products and services to treat, mitigate, or prevent the specific medical conditions that you have been diagnosed with.

I don’t have an HSA/FSA. Can I still benefit from Truemed?

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA!

What Summit related services are eligible for HSA/ FSA reimbursement?

Your Letter of Medical Necessity will approve you for reimbursement of all membership and training (group and personal training) related fees at Summit Athletic Club.